why are reits tax efficient

Introduction Creating a Tax-Efficient ETF Portfolio. VNQs dividends are considered non-qualified and are thus taxed as ordinary income so I hold VNQ in my IRA.

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

REITs by their very structure are not particularly tax-efficient As long as a REIT pays out more than 90 of net income it pays NO corporate taxes so there is no double taxation.

. The Best ETFs for Taxable Accounts. It can be a way for you to invest less capital so that in 5 10 or 15 years when youre ready to purchase or manage properties on your own your capital has appreciated by the same amount as the broader real estate market. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates.

Get your free copy of The Definitive Guide to Retirement Income. Our Portfolios Of Publicly Traded Real Estate Companies Help Reach Investor Objectives. Theres another reason to put REITs in tax-advantaged accounts.

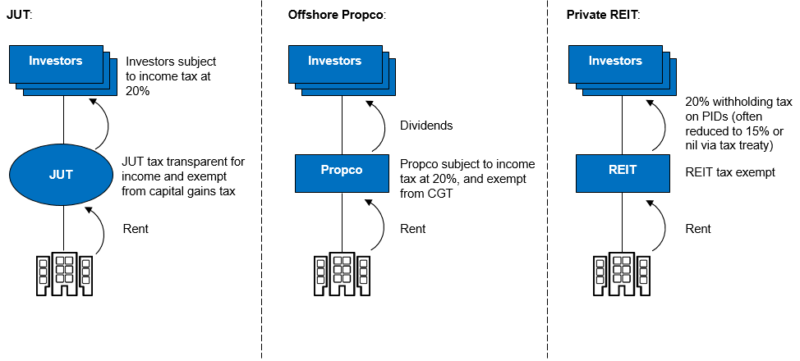

This section of the article examines why funds use REITs for the benefit of foreign investors how various types of foreign investors including pension funds. Tax Efficiency By holding a REIT in my Roth I can lower my tax rate on REIT income from 24 to 0. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income.

ETFs are vastly more tax efficient than competing mutual funds. ITOT iShares Core SP Total US. While REITs are less tax efficient than qualified dividend-paying US equities the extent of their inefficiency is overstated and misunderstood.

A benefit of investing in a fund with exposure to multiple properties is built-in diversification without the headache of multiple state income tax filings. When looking at after-tax total returns the effective tax rate gap between REITs and corporates is typically much closer than generally perceived. By the Fundrise Team December 14 2018.

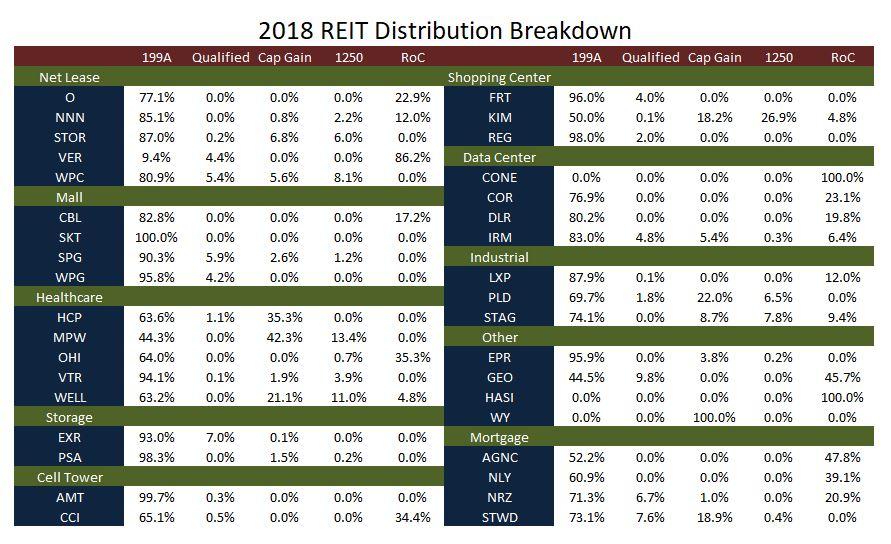

At Fundrise we structure all of our investments with the goal of maximizing risk adjusted returns for our investors. Note that ROC from REITs is the most tax efficient payout as the distribution is converted into a potential capital gain to be paid later at the time of disposition. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

The other is that you lose the growth that money could. REIT investors can deduct up to 20 of ordinary dividends before income tax is assessed. Ad Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do.

However this deduction will end in 2025. A byproduct of this is maximizing tax efficiency so that investors take home as. The Tax Cuts and Jobs Act TCJA provides a 20 deduction for pass-through business income including a qualified REIT dividend.

Final Conclusion The 3 Reasons I Hold REITs in my Roths Diversification REITs are real estate companies and I like that this is a different asset than the businesses that. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits. A REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing properties.

Not only because you declare the distribution as income on your taxes but because there can also be a return of capital ROC and that impacts your accounting. The distributions are only taxed at the personal tax rate of the investor who received the dividend so better for the low income tax payer. There are two reasons for this.

Real Estate Investment Trusts REITs are known as. REITs are known for their tax efficiency potentially helping investors take home as much of their earnings as possible. Taxpayers may also generally deduct 20 of the combined qualified business income amount which includes Qualified REIT Dividends through Dec.

The portion of a REIT dividend classified as income may be eligible for preferential tax treatment. IXUS iShares Core MSCI Total International Stock ETF. VTEB Vanguard Tax-Exempt Bond ETF.

Their dividend tax rate is much higher than dividends on stocks. REITs pay out roughly 65 of their distributions as. Under the goal of democratizing real estate investing for the masses REITs enjoy significant tax advantages.

Tax efficiency of REITs is compared to qualified dividends through an equivalent qualified yield ratio. I wonder why so many articles I read. While REITs may experience day-to-day volatility and behave like equities in the.

This includes avoiding double taxation thats always somehow passed through to the. However the newish tax law grants a 20 deduction for pass through income like REITs. If a mutual fund or ETF holds securities that have appreciated in value and sells them for.

An analysis of Burton G. One is that you lose the money you pay in taxes. Malkiel of Wealthfront found that the dividend tax rate for REITs is 43 compared with 25 for US.

Residents may be subject to a 30 withholding tax on their REIT. We view valuations on REITs as attractive relative to the broader equity markets based on our multi-asset real return framework. REITs provide a particularly tax-efficient solution for the tax issues faced by foreigners when investing in US.

VUG Vanguard Growth ETF. Ad Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios. IVV iShares Core SP 500 ETF.

How Tax Efficient Are Your Reits Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-02-ba61fb5a7de74ce8b29266f0607d3a88.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

24 Best Canadian Reit Stocks Currentyear Reit Real Estate Investment Trust Investing Money

How To Buy Stocks In Canada A Beginners Guide To Investing In Stocks In 2021 Investing In Stocks Investing Money Management Advice

Guide To Reits Reit Tax Advantages More

5 Tax Sheltered Investments That You Didn T Know About Investing Business Bank Account Online Business Opportunities

Reits Vs Real Estate Mutual Funds What S The Difference

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Sec 199a And Subchapter M Rics Vs Reits

Guide To Reits Reit Tax Advantages More

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Charles Schwab Tips Re Tax Efficient Investing Investing Finance Investing Accounting

5 Tax Planning Fundamentals For Investors Investing Investing Strategy Tax

How To Build An Income Portfolio Using 12 Simple Steps My Own Advisor Dividend Investing Investing Income

How To Invest In Reits In The Uk Raisin Uk

The Continuing Rise Of The Reit

Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 India Corporate Law

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo